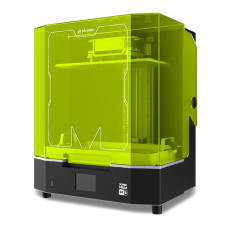

Resin 3D Printers

Jump to Section:

- What is resin 3D printing?

- What are applications of resin 3D printing?

- Why buy resin 3D printers?

- Which resin 3D printers should I buy?

- What materials are supported by resin 3D printers?

- What software can I use with resin 3D printers?

- What parts and accessories are available for resin 3D printers?

- What is the difference between FDM and resin 3D printers?

- What post-processing equipment do I need for resin 3D printers?

- What are the best resin 3D printers?

What is resin 3D printing?

Resin 3D printing stands at the forefront of precision manufacturing. It offers unparalleled detail and surface smoothness due to its use of UV light to cure liquid photopolymer resin layer by layer. This technology is essential for applications demanding high accuracy, such as in dental applications, jewelry, and prototyping.

Despite its advantages in producing intricate details, resin 3D printing involves a complex post-processing workflow, including washing and curing process, and necessitates strict adherence to safety protocols due to the hazardous nature of uncured resin. The cost of materials and equipment may also be higher compared to the filament-based printing process. Nevertheless, for projects requiring the utmost precision, resin 3D printing remains an unmatched method.

What are applications of resin 3D printing?

Resin 3D printing is pivotal in fields requiring supreme accuracy and fine detail. It's extensively used in creating jewelry for intricate designs, dental industry for precise parts, models, and in prototyping for higher resolution. In the realm of gaming miniatures, this technology is capable of bringing fantasy characters to life with crisp detail.

Beyond aesthetics, resin 3D printing offers functional diversity with the ability to create prints with specific thermal, chemical, or mechanical properties. This technology excels in specialized manufacturing and design.

Why buy resin 3D printers?

Unmatched Detail and Precision: Resin 3D printing, utilizing stereolithography (SLA), digital light processing (DLP), or masked stereolithography (MSLA) technologies, excels in producing high-quality prints with impressive detail and smooth surfaces. These printers are ideal for applications requiring complex form, such as jewelry, dental models, and highly detailed prototypes.

Superior Surface Finish: Compared to filament-based 3D printing, resin 3D printers are capable of achieving a much smoother surface finish straight out of the printer. This characteristic is particularly valuable in industries where the aesthetic quality of the final product is paramount, reducing the need for extensive post-processing.

Wide Range of Material Properties: Resins can be engineered to exhibit various properties, including flexibility, durability, and resistance to temperature and chemicals. This adaptability opens up opportunities for the production of functional prototypes and end-use parts in fields such as automotive, aerospace, and consumer goods.

Efficient Prototyping: The accuracy of resin 3D printing makes it the method of choice to produce small, complex components that would be challenging to produce with other techniques due to their form. Its capability to handle intricate features without sacrificing print speed or quality is particularly beneficial for the medical, dental, jewelry, and electronics industries.

Cost-Effective for Small Batch Production: The lack of need for tooling and the printer's ability to produce ready-to-use, high-quality printed parts without additional finishing make it an economical option for printing limited quantities of custom or specialized items.

Which resin 3D printer should I buy?

Here is a list of some of the most popular resin 3D printers to choose from:

Creality

Creality's HALOT printer series elevates the resin 3D printing process with technical prowess, featuring the HALOT-PLAY’s 4K resolution on an 8.9" LCD, and the HALOT-MAGE series advancing to 8K with a 10.3" LCD for unparalleled detail. These resin printers are capable to achieve rapid curing times through an optimized light source, enhancing productivity without sacrificing quality. Dual linear rails ensure Z-axis stability across the range, minimizing layer shifts. Smart features, including resin auto-feed and air purification, streamline the printing process, while connectivity through Creality Cloud facilitates remote management. The series embodies high-resolution, efficient resin printing with user-centric innovation.

Phrozen

Phrozen's cutting-edge resin printers, including the Sonic Mini 4K and 8K S, Mighty 12K, and Mega 8K versions, set industry standards with high resolutions up to 12K and XY precision as fine as 22 µm. These printers feature up to 15-inch build plates for expansive printing capabilities and incorporate monochrome LCDs for a rapid 3D printing process. The automated resin feeding system, dual air purifiers and handy accessories for post-processing enhance printing efficiency and workspace safety. Phrozen resin printers support a broad spectrum of professional and hobbyist applications by combining large print volumes, ultra-high resolution, and user-oriented design into a compact, efficient package.

ELEGOO

Elegoo's portfolio showcases technological advancements with machines like the Mars 4 Ultra resin printer featuring a 7-inch 9K mono LCD for 18 µm precision, and the Saturn 3 with a 10-inch 12K mono LCD ensuring 19 x 24 µm XY resolution. Their resin printers support significant build volumes, up to 218.88 × 122.88 × 250 mm for the Saturn 3, accommodating large-scale models. Innovations such as Fresnel collimating lenses for uniform UV exposure and dual Z-axis linear rails for stability enhance print fidelity. Air filtration systems mitigate resin odors, improving the printing environment. Elegoo combines high-resolution printing with user-friendly mechanisms to deliver professional-grade 3D printing solutions.

Anycubic

Anycubic leads the resin 3D printing sector with its Photon series, integrating high-resolution displays and large build volumes to accommodate both hobbyists and professionals. The Photon Mono 2 resin printer caters to beginners with its 6.6-inch 4K+ LCD, offering a generous print volume and enhanced light matrix. The Mono M5s Pro steps up with a 10.1-inch 14K HD screen, air heater, and purification system, pushing print speeds to 105 mm/h. For those demanding even larger builds, the M3 Max showcases a 13.6-inch 7K screen and expansive 298 x 164 x 300 mm build platform. Anycubic's innovation in UV light uniformity and smart feeding systems ensures detailed resin prints and operational efficiency.

Nexa3D

Nexa3D stands out in the resin 3D printing industry by offering machines that combine high speed, large build volumes, and precise details. Their product range, including the XiP, XiP Pro, and NXE 400Pro, caters to both desktop and industrial applications. Nexa3D's printers leverage Lubricant Sublayer Photo-curing (LSPc) technology, enabling unmatched printing speeds up to 18 cm/hour for the XiP and even faster for industrial models. They support a wide array of printing materials, from durable resins to flexible and heat-resistant options, providing versatility for various prototyping and production needs. With features like large build volumes up to 19.5L, modular designs for easy upgrades, and open material platforms, Nexa3D is positioned as a leader in efficient and high-quality resin 3D printing solutions.

Zongheng3D

Zongheng3D's Super Maker SLA printers, from the compact SLA 300 to the expansive SLA 1700, sets new standards in precision and scale for SLA technology. Featuring resolutions down to 25 microns and build volumes up to 1700 x 850 x 650 mm, these large-format printers deliver unparalleled details and size capabilities. With UV lasers for accurate calibration, print speeds up to 6000 mm/s, and customizable layer thickness between 0.05–0.2 mm, they offer robust solutions for large-scale productions. The series is designed for versatility in professional applications, offering a wide range of photosensitive resins and advanced features like automatic vacuum adsorption coating and continuous process monitoring.

Original Prusa

The Original Prusa SL1S SPEED resin printer elevates MSLA technology to new heights, offering exceptional print quality with resolutions as low as 25 micron. This fully assembled unit integrates a high-resolution monochrome LCD and UV LED array for high surface quality, significantly reducing exposure times to just 1.4 seconds per layer. It's designed for a variety of applications, from creating models, detailed sculpts to industrial high-quality prototypes, supported by an expansive ecosystem that includes PrusaSlicer software and a wide range of compatible resins. Encased in a heavy aluminum body for stability, the SL1S SPEED is Prusa3D's fastest and most detailed printer yet.

Frequently Asked Questions

What printing materials are supported by resin 3D printers?

Resin printers utilize a range of photopolymer resins that can be cured layer by layer using ultraviolet light. Different materials allow for the production of printed objects with varying properties, including mechanical, thermal, and chemical characteristics. Available resins include flexible, rubber-like, heat resistant, and even printing materials that mimic the appearance and feel of ceramics or metals. This diversity in resin types enables the creation of highly detailed and precise models suited for numerous applications.

What software can I use with resin 3D printers?

Resin printers are capable to work with multiple slicing software options, including CHITUBOX, PreForm, Z-SUITE, PrusaSlicer, Lychee Slicer, Photon Workshop, NanoDLP, etc. These slicers offer features from beginner-friendly interfaces and automatic support generation to advanced tools for mesh repair and manual support editing. While most are free, some, like Formware 3D, are paid. Each program has unique strengths, catering to various users from hobbyists to professionals.

What parts and accessories are available for resin 3D printers?

Resin printers support a wide range of accessories provided by their manufacturers, including FEP films, build plates, resin vats, air purifiers, screen protectors, LCD screens, and UV LED modules. These components are designed for optimal performance, allowing for upgrades, repairs, or enhancements to 3D printing or post-processing.

What is the difference between FDM and resin 3D printers?

FDM (Fused Deposition Modeling) printers use plastic filaments. They heat and extrude these filaments layer by layer to form objects. Resin printers, involving machines based on DLP or SLA technologies, use liquid resin cured by a UV light source layer by layer. A resin printer offers higher precision and smoother finishes than FDM. However, FDM printers generally print larger objects faster and at a lower cost. Resin requires more post-processing, including washing and curing process. Safety precautions are also necessary due to the toxic nature of resin.

What post-processing equipment do I need for resin 3D printers?

For resin 3D printers, post-processing requires washing and curing stations. Wash the parts in isopropyl alcohol to remove uncured resin. Then, use a curing station with a UV light source for complete polymerization. This equipment ensures that printed parts achieve their final strength and surface quality. Some manufacturers offer integrated solutions combining washing and curing for convenience.

What are the best resin 3D printers?

To learn the best models of resin printers in 2023, read our article including a buyer’s comprehensive guide on how to choose a resin 3D printer.